Know someone who would like this newsletter? Forward it to them.

The World

Xi Jinping to test limits of friendship with Putin on Russia state visit: Days after Vladimir Putin was hit with an international warrant for alleged war crimes in Ukraine, Xi Jinping’s first state visit to Moscow in four years is a demonstration of the Chinese leader’s commitment to Russia’s president — but is also set to show the red lines in what the pair last year dubbed a “no limits partnership”. Putin, who travelled defiantly to occupied Ukrainian territory at the weekend after the International Criminal Court warrant, will hope that Xi’s three-day visit from Monday will lend legitimacy to his invasion of Ukraine and that China might pledge material support to help his military fight it. But there are signs that Xi will remain guarded over the potential costs of friendship with Russia’s leader, particularly in Europe as Beijing tries to boost trade after its zero-Covid policy savaged its economy last year. And despite warnings from the US that China was considering sending arms to Russia, there is as yet little evidence of substantial flows of weapons between the two countries. (Financial Times)

China’s ties with Russia firm as ever, Communist Party paper says ahead of Xi Jinping’s state visit to Moscow: ‘The more volatile the world is, the more steadily China-Russia relations should move forward’, People’s Daily commentary says. (South China Morning Post)

Russia will present Xi's trip - his first since securing an unprecedented third term this month - as evidence that it has a powerful friend prepared to stand with it against a hostile West that it says is trying in vain to isolate and defeat it. (Reuters)

Xi’s visit to Russia, just after cementing his precedent-breaking third term in power, brings together two men who have positioned themselves as leaders for life — and it sets the scene for global confrontation, with Beijing willing to use its partnership with Moscow to counter Washington, even if that means granting tacit approval to Putin’s brutal, destabilizing war. “The grim outlook in China is that we are entering this era of confrontation with the U.S., the gloves are off, and Russia is an asset and a partner in this struggle,” said Alexander Gabuev, an analyst with the Carnegie Endowment for International Peace. (Washington Post)

Is the United States Creating a ‘Legion of Doom’? The emerging China-Russia-Iran axis may force the United States to choose between some unappealing options. (Politico)

Analysis: American and European officials are watching for something else altogether — whether Mr. Xi will add fuel to the full-scale war that Mr. Putin began more than a year ago. U.S. officials say China is still considering giving weapons — mainly artillery shells — to Russia for use in Ukraine. And even a call by Mr. Xi for a cease-fire would amount to an effort to strengthen Mr. Putin’s battlefield position, they say, by leaving Russia in control of more territory than when the invasion began. (New York Times)

North Korean leader Kim Jong Un called for the country to stand ready to conduct nuclear attacks at any time to deter war, accusing the U.S. and South Korea of expanding joint military drills involving American nuclear assets, state media KCNA said. Kim's remarks came as the isolated country conducted what KCNA called exercises aimed at bolstering its "war deterrence and nuclear counterattack capability" on Saturday and Sunday to send strong warnings against the allies. (Reuters)

President Biden told Israeli Prime Minister Benjamin Netanyahu during a phone call on Sunday that democratic values — including “genuine checks and balances” — had to remain a pillar of the U.S.-Israel relationship, a veiled warning to Netanyahu about his incendiary plan to overhaul the country’s judicial system. During the phone call between the two leaders, Biden expressed “concern” about Netanyahu’s plan in a “candid and constructive conversation” that lasted about 45 minutes, according to a senior administration official, who requested anonymity to discuss a diplomatically sensitive conversation. (Washington Post)

California is bracing for more heavy rain and snow early this week as another fast-moving storm roars in off the Pacific Ocean. Large areas of the state’s coastline will get up to 1.5 inches (3.8 cm) of rain from the storm that’ll arrive late Monday and spread through the region Tuesday, said Brian Hurley, a meteorologist with the US Weather Prediction Center. More than 12 inches of snow could fall in the mountains around Los Angeles and San Bernardino counties, with as many as four feet coming down in the Sierra Nevada range further to the east. (Bloomberg)

Economy

UBS agreed to take over its longtime rival Credit Suisse for more than $3 billion, pushed into the biggest banking deal in years by regulators eager to halt a dangerous decline in confidence in the global banking system. The deal between the twin pillars of Swiss finance is the first megamerger of systemically important global banks since the 2008 financial crisis when institutions across the banking landscape were carved up and matched with rivals, often at the behest of regulators. The Swiss government said it would provide more than $9 billion to backstop some losses that UBS may incur by taking over Credit Suisse. The Swiss National Bank also provided more than $100 billion of liquidity to UBS to help facilitate the deal. (Wall Street Journal)

The Biden administration is under mounting pressure to call for an expansion of the federal guarantee on bank deposits to shore up confidence in the financial system and prevent further distress among US regional banks. The FDIC, which is funded by banks, guarantees deposits up to $250,000. But a growing chorus of influential bipartisan lawmakers and banking industry lobbyists have been pushing for that limit to be increased or suspended. “I think that lifting the . . . cap is a good move,” Elizabeth Warren, the Democratic senator from Massachusetts, told CBS on Sunday. “Is it $2mn? Is it $5mn? Is it $10mn? Small businesses need to be able to count on getting their money to make payroll, to pay the utility bills. Non-profits need to be able to do that,” she added. (Financial Times)

Bitcoin Thrives in Chaos, Breaks Above $28,000 For First Time Since June. (Bloomberg)

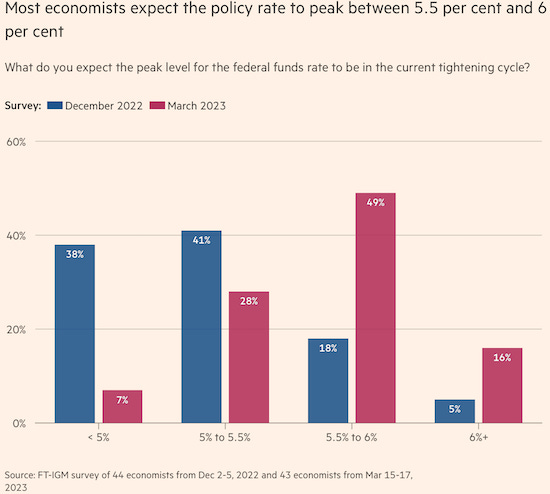

The Federal Reserve will keep raising its benchmark policy rate, holding it above 5.5 per cent for the rest of the year, despite turmoil across the US banking sector, according to a majority of leading academic economists polled by the Financial Times. The latest survey, conducted in partnership with the Initiative on Global Markets at the University of Chicago’s Booth School of Business, suggests the US central bank still has work to do to stamp out stubbornly high inflation, even as it contends with a crisis among midsize lenders following the implosion of Silicon Valley Bank. Of the 43 economists surveyed between March 15 and 17 — just days after US regulators announced emergency measures to stem contagion and fortify the financial system — 49 per cent forecast the federal funds rate to peak between 5.5 per cent and 6 per cent this year. That is up from 18 per cent in the previous survey in December and compares to the rate’s current level of between 4.50 per cent and 4.75 per cent. (Financial Times)

Former Goldman Sachs chief executive Lloyd Blankfein said the Federal Reserve can take a pause hiking interest rates this week as the unfolding bank crisis will effectively tighten lending standards in the economy. (Bloomberg)

The world's leading central banks jointly announced new action to try to keep U.S. dollars flowing easily through the global banking system, returning to a strategy used extensively in past crises. The Federal Reserve, along with the European Central Bank, Bank of England, Bank of Canada, Bank of Japan, and Swiss National Bank, with their Sunday evening (U.S. time) aimed to make dollar swap lines more readily available. (Axios)

Mars chief hits out at ‘nonsense’ attacks on corporate ESG: Companies that back off their social and environmental commitments in the face of “nonsense” political attacks risk alienating a generation of talent, Mars’ new chief executive has warned as he raised the prospect of doubling the group’s revenues over the coming decade. Sales at the family-owned petcare, chocolate and chewing gum group “could well double in a decade” to $90bn, Poul Weihrauch told the Financial Times in his first interview since becoming CEO last September. However, he added, its more important target was “responsible” growth. (Financial Times)

Technology

Inside Apple’s Companywide Cost-Cutting Push to Avoid Layoffs: Apple is pulling every lever it can to cut costs enough to avoid laying off full-time employees. Here is what Apple has done so far to avoid layoffs. (Bloomberg)

The company is delaying bonuses for corporate teams that previously received payouts twice a year. Now, those teams will get their entire bonus in October, matching the schedule of most colleagues. While Apple has already factored that money into its finances, it gets to keep that cash on hand a little longer.

Some projects, including new home devices like a HomePod with a screen, have been pushed back until next year at the earliest. That allows Apple to allocate its research and development budget to more pressing projects.

The company has reined in budgets across several teams and is now requiring senior vice president approval for more items.

Apple has completely paused hiring on some teams and severely limited hiring on others.

When some people leave their positions, Apple is keeping those roles open rather than filling them.

Apple adds personal shoppers to online store via one-way video chat. The company introduced an interesting new way to shop on its online store, allowing buyers to video chat with an Apple specialist during iPhone purchases. The timing coincides with the release of the yellow iPhone 14, and the next six months or so will probably serve as an important test ahead of the iPhone 15 launch in the fall. Users will be able to see the Apple employee and their screen, but the company will be unable to see the customer. This could help people who don’t live near an Apple outlet or are unable to go to a store get a bit of the in-person experience. (Bloomberg)

Public release of iOS 16.4 gets closer. Apple is continuing to pump out beta versions of its next iPhone and iPad software, which should be released to all users — alongside updates to macOS, watchOS and tvOS — in the next three weeks or so. (Bloomberg)

UChicago researchers launch a free app to help artists prevent AI models from stealing their “artistic IP”, by adding imperceptible “perturbations” to their art. (TechCrunch)

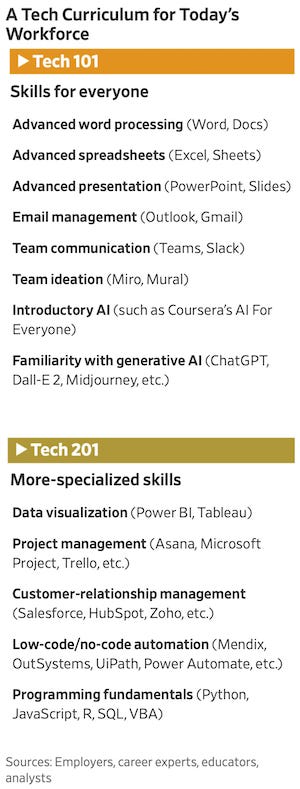

An explosion of analytical, organizational and communication technologies is remaking every aspect of office work. Whether people work in sales, marketing, project management, design or many other fields, employers expect them to manipulate and analyze data, and bundle it into slick presentations. And as remote work has become the norm, people must know the advanced features of online collaboration. “There is no debate as to whether technology is not just an enabler, but is really a driver of disruption, of change, of value, within organizations,” says Columbia Business School dean Costis Maglaras. “And as a result, [there] needs to be some core knowledge that people need to bring with them, even if they’re not going to be technologists themselves.” Tech research and advisory firm Gartner’s 2022 Digital Worker Survey found that the average office worker uses 11 applications on the job, and 17% use 16 or more apps. The skills needed: Create compelling presentations; Master communication tools; Make things automatic. (Wall Street Journal)

Smart Links

First Republic CEO Told Regulators Earlier This Year His Bank Didn’t Need More Rules (The Information)

Newsom announces $50-million contract to make California’s own brand of insulin. (Los Angeles Times)

The Problem With Your Dying AirPods and Other Bluetooth Earbuds: When earbuds’ tiny lithium-ion batteries die, they can’t be replaced. (Wall Street Journal)

Samsung to invest in South Korea mega chip-making plan. (BBC News)