Know someone who would like this newsletter? Forward it to them.

The World

Banks Lose Billions in Value After Tech Lender SVB Stumbles: Investors dumped shares of SVB Financial Group and a swath of U.S. banks after the tech-focused lender said it lost nearly $2 billion selling assets following a larger-than-expected decline in deposits. The four biggest U.S. banks lost $52 billion in market value. Banks big and small posted steep declines. PacWest Bancorp fell 25%, and First Republic Bank lost 17%. Charles Schwab Corp. fell 13%, while U.S. Bancorp lost 7%. America’s biggest bank, JPMorgan Chase & Co., fell 5.4%. Thursday’s rout is another consequence of the Federal Reserve’s aggressive campaign to control inflation. Rising interest rates have caused the value of existing bonds with lower payouts to fall in value. Banks own a lot of those bonds, including Treasurys, and are now sitting on giant unrealized losses. (Wall Street Journal)

Joe Biden has proposed big tax increases for US corporations, investors and the wealthiest Americans as part of a sweeping budget plan that the White House said would reduce the federal deficit by nearly $3tn over the next decade: (Financial Times)

The proposed tax rises include a 25 per cent minimum tax for billionaires, a 28 per cent corporate tax rate, and a doubling of the tax rate on US multinationals’ foreign earnings from 10.5 per cent to 21 per cent.

The White House has also called for a quadrupling of the tax rate on corporate share buybacks, from 1 per cent to 4 per cent, and a reversal of former president Donald Trump’s tax breaks for Americans earning more than $400,000 a year.

The administration’s plan also includes a proposal to increase the rate of tax on capital gains for people with annual incomes of more than $1mn, and end the so-called carried-interest loophole that reduces the tax burden for fund managers.

15 budget asks that are actually Biden's reelection pitch: The president looked to reinforce his image as an ally of working families, calling for measures to counter Chinese aggression, save Medicare from insolvency and tackle tax loopholes. (Politico)

Xi Jinping began an unprecedented third term as China’s president after he was endorsed by a unanimous vote from the 2,977-member National People’s Congress (NPC). Xi will head a hand-picked party and government team tasked with steering the world’s second-largest economy through challenges at home and abroad over the next five years. Analysts say it will be a critical period for both Xi and China as he needs to put the country back on an economic growth path to convince the world that China’s unique governance and development model works and that his ambitious political legacy is within reach amid intensified rivalry with the US, the potential for conflict over Taiwan and concerns about the economic impact of China’s rapidly ageing population. (South China Morning Post)

China's parliament began considering legislative changes that would slash the time needed to pass laws in emergencies, a move that observers see as preparing for scenarios like a conflict over Taiwan. Proposed amendments to the Legislation Law would let the Standing Committee of the National People's Congress put bills to a vote after just one meeting during an "emergency," shortening a process that usually takes half a year or more. (Nikkei Asia Review)

French institute severs ties with China: The influential Pasteur Institute in France will cease to co-lead an infectious-disease institute in Shanghai that it established in 2004 in partnership with the Chinese Academy of Sciences. What initiated the break-up isn’t clear. (Nature)

North Korea's Kim Jong Un ordered the military to intensify drills to deter and respond to a "real war" if necessary, state media said on Friday, after the leader oversaw a fire assault drill that it said proved the country's capabilities. North Korea fired a short-range ballistic missile off its west coast on Thursday, South Korea's military said, adding it was analysing possibilities the North may have launched multiple missiles simultaneously from the same area. (Reuters)

Sunak Gets Approval Bump After Northern Ireland Deal: British Prime Minister Rishi Sunak's approval rating rose 5 points following the announcement of a deal with the European Union that resolved the tricky issue of managing customs in Northern Ireland. The move was broadly popular, though a majority of British adults continue to disapprove of his job performance. (Morning Consult)

War in space: U.S. officials debating rules for a conflict in orbit. In a recent interview, Gen. David Thompson, the Space Force’s vice chief of operations, said that while expanding the partnership with the commercial space industry is one of his top priorities, it has also led to a host of unanswered questions. “The Ukraine conflict has brought it to the forefront,” he said. “First, commercial companies are thinking very clearly and carefully about, can we be involved? Should we be involved? What are the implications of being involved? … And on our side, it’s exactly the same thing. Should we depend on commercial services? Where can we depend on commercial services?” The discussions come as the Pentagon is investing in more systems that were originally developed for civilian use but also have military applications. In the National Defense Strategy released late last year, the Pentagon vowed to “increase collaboration with the private sector in priority areas, especially with the commercial space industry, leveraging its technological advancements and entrepreneurial spirit to enable new capabilities.” (Washington Post)

What first looked like a pandemic blip has turned into a crisis. Nationwide, undergraduate college enrollment dropped 8% from 2019 to 2022, with declines even after returning to in-person classes, according to data from the National Student Clearinghouse. The slide in the college-going rate since 2018 is the steepest on record, according to the U.S. Bureau of Labor Statistics. Economists say the impact could be dire. (Associated Press)

American grandmas. Grandmothers are coming in to save the day as rising childcare costs push more and more parents to choose between their careers or having children. A recent Harris Poll showed that 42% of working parents rely on grandmothers for childcare, and 92% of Americans believe that grandmas are contributing significantly to the economy. (Fortune)

California declares state of emergency as subtropical storm moves over state: Governor has 21 counties under emergency orders while 16m people in the state are under flood watch warnings. (The Guardian)

New storm could bring more peril to California rivers already hit by deadly flooding: A powerful storm barreling toward California from the tropical Pacific threatens to trigger widespread river flooding throughout the state as warm rain melts a record accumulation of snowpack and sends runoff surging down mountains and into streams and reservoirs. Although state officials insist they are prepared to manage runoff from what is now the 10th atmospheric river of a deadly rainy season, at least one expert described the combination of warm rain, epic snowpack and moist soils as “bad news.” (Los Angeles Times)

China has a closing window of opportunity to reform its antiquated restrictions on retirement and rural mobility, according to policy influencers who are concerned about the nation’s failure to better tap into its “demographic dividend” and address an urgent need to cultivate a larger working-age cohort to support fewer retirees. A widening demographic imbalance – resulting from a low birth rate combined with a rapidly ageing population – continues to plague the world’s second-largest economy, which long benefited from a huge demographic dividend. (South China Morning Post)

U.S. President Joe Biden's climate bill is only six months old, but its impact on the energy industry around the world continues to grow as pressure mounts on countries to offer similar subsidies toward green energy or risk losing out on valuable investment dollars. The Inflation Reduction Act (IRA) is a multi-billion-dollar program that pledges government dollars toward developing low-carbon energy. The policy is aimed at boosting the country's manufacturing sector and takes aim at China's dominant position in the clean energy technology supply chain. The legislation is regarded as the most ambitious climate bill ever passed in the U.S. Still, the IRA could force governments around the world, including Canada, to introduce their own sweeping series of subsidies and have a much larger impact on climate change. (CBC)

The bi-annual changing of the clocks takes place this Sunday, but some federal lawmakers hope it's the last time we “spring forward” as they push to make daylight saving time permanent. Driving the news: Sen. Marco Rubio (R-Fla.) has reintroduced the Sunshine Protection Act, which was surprisingly approved by a unanimous vote in the Senate last year but wasn't voted on by the House. The bill would eliminate the changing of clocks and “if enacted, the U.S. would not ‘fall back’ in November and would enjoy a full year of DST, instead of only eight months,” according to a fact sheet on the bill. Rep. Vern Buchanan (R-Fla.) introduced companion legislation in the House. It’s unclear if Congress will take up the legislation again but both bills have been referred to committees. The offices of Majority Leader Chuck Schumer and House Speaker Kevin McCarthy did not immediately return a request for comment. (Axios)

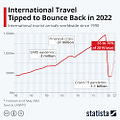

International Travel Bounced Back Strongly in 2022. (Statista)

Economy

Inflation seems poised to stick around for longer than previously expected, according to new research from the Federal Reserve Bank of New York. Revisions to US inflation reports released in January showed that price gains in the last three months of 2022 as measured by the personal consumption expenditure price index were stronger and more broad based than previously thought, New York Fed researchers explained in a blog post published Thursday. Those adjustments, combined with data showing that another hot inflation reading for January, point to more persistent price pressures, the researchers said. Their analysis is based on a New York Fed model known as the Multivariate Core Trend, or MCT. Using the revised data for the end of 2022, the December estimate for the model would have been 4.3%, greater than the 3.7% that was previously calculated. The reading rose to 4.9% in January. (Bloomberg)

Proposed E.U. rules would make it easier for member states to match subsidies being offered under the United States' Inflation Reduction Act in an effort to keep European companies from moving operations across the Atlantic. European Commission President Ursula von der Leyen and U.S. President Joe Biden are set to meet Friday, and they're expected to discuss the European Union's request for its companies to be granted benefits under the U.S. law. (Financial Times)

JPMorgan Says ‘Shockingly Low’ Number of Startups in Asia Led by Women: Only 5.7% of startups in Asia-Pacific are led by female entrepreneurs, a percentage that has stayed stagnant for five years, according to a JPMorgan Chase & Co. study. “The number is shockingly low,” Kam Shing Kwang, chief executive of the JPMorgan’s Asia private bank, said in an interview. “I think sometimes we focus on a few very successful women and say, oh we have arrived. We are minorities.” Women remain heavily under-represented at the top echelons in high-growth private businesses in the region, with only 848 of nearly 15,000 firms across the region led or founded by a woman, according to the study. (Bloomberg)

PM Fumio Kishida vowed to “work even harder” to tackle the massive gender pay gap in Japan, where women earn 75% of what men do for full-time work. The Land of the Rising Sun has ranked abysmally on the World Economic Forum’s gender parity report despite efforts by successive governments to tackle the issue. (GZERO Media)

South Africa’s shrinking economy: Things are going from bad to worse in South Africa. Amid a deepening energy crisis that’s plunged parts of Africa’s most industrialized nation into darkness for up to 15 hours a day, new figures show that the country’s economy contracted by 1.3% in the last quarter of 2022. (Analysts had anticipated a 0.4% squeeze). In a bid to address the deep-rooted energy crisis, President Cyril Ramaphosa this week tapped a new electricity minister, but members of the business community don’t appear to have been placated as fear remains high that Pretoria could be headed for a recession. Crucially, South Africa's economy is just marginally bigger than it was four years ago (0.3%), but the population has grown by 3.5% since then, increasing pressure on ailing infrastructure. (GZERO Media)

The Biden administration is requesting $27.2 billion for NASA for its 2024 budget, with substantial funding for the space agency’s Artemis program, which aims to return humans to the moon this decade. The amount, released as part of the White House’s “skinny budget” request for the federal government on Thursday, is $1.8 billion more than Congress granted NASA in its 2023 budget. The skinny budget, which outlines the president’s spending priorities, contained limited details. (Bloomberg)

Biden sticks it to Republicans with his budget proposal (Politico)

Even Wealthy Landlords Are Skipping Payments on Office Buildings. Wall Street titans pride themselves on knowing when to take risks, especially in moments of uncertainty. But as borrowing costs soar and the work-from-home trend leaves downtown offices half empty, even the biggest players are quickly realizing they miscalculated. Take Pacific Investment Management Co. In 2021, even after offices emptied during the pandemic, funds managed by the $1.7 trillion asset manager acquired Columbia Property Trust, which owned at least 15 office buildings in New York, San Francisco, Boston and Washington, DC, for $3.9 billion, including debt. “High-quality office buildings in major US cities offer long-term value for our clients,” Pimco’s global head of private commercial real estate, John Murray, said at the time. Or not. Last month, Columbia Property Trust defaulted on about $1.7 billion worth of mortgages on seven of its trophy buildings, including a San Francisco tower leased to Elon Musk’s Twitter and the former New York Times headquarters, now home to Snap. (Bloomberg)

California on Thursday sued one of its picturesque coastal cities and accused it of refusing to build more affordable housing, an issue Democratic Gov. Gavin Newsom called the “original sin” of the state’s housing shortage. Attorney General Rob Bonta sued Huntington Beach, a city of about 200,000 people along the Southern California coast where the median home sales price is $1.1 million — or more than $300,000 higher than the state average. Bonta is asking a judge to order Huntington Beach City Council to comply with state housing laws and to punish councilmembers by making them pay a fine. (Associated Press)

Texas has resolved a two-year federal civil rights complaint and will move forward with a major highway expansion in Houston, a project neighborhood groups fear will displace residents and lead to more pollution. The Federal Highway Administration and the Texas Department of Transportation said Thursday they’ve struck a deal to allow the state to resume work on its $9 billion plan to add several lanes to Interstate 45 and expand other freeways around the city’s urban core — which state transportation planners say is needed as more people move to the region. (Texas Tribune)

Technology

ChatGPT, OpenAI’s viral, AI-powered chatbot tech, is now available in a more enterprise-friendly package. Microsoft today announced that ChatGPT is generally available through the Azure OpenAI Service, the company’s fully managed, corporate-focused offering designed to give businesses access to OpenAI’s technologies with added governance and compliance features. Customers, who must already be “Microsoft managed customers and partners,” can apply here for special access. (TechCrunch)

Elon Musk is planning to build his own town on part of thousands of acres of newly purchased pasture and farmland outside Austin, according to deeds and other land records and people familiar with the project. In meetings with landowners and real-estate agents, Mr. Musk and employees of his companies have described his vision as a sort of Texas utopia along the Colorado River, where his employees could live and work. (Wall Street Journal)

Apple is launching a new music streaming service focused on classical music. Based on its 2021 acquisition of Amsterdam-based streamer Primephonic, the new Apple Music Classical app will offer Apple Music subscribers access to more than 5 million classical music tracks, including new releases in high-quality audio, as well as hundreds of curated playlists, thousands of exclusive albums and other features like composer bios and deep dives on key works, Apple says. (TechCrunch)

A letter from CEO Mary Barra sent to GM workers on Thursday offered buyouts to many of its 58,000 employees, saying the company plans to trim $2 billion in fixed costs over the next two years. GM announced its plan to cut costs in January, on the same earnings call where it announced a record income of $14.5 billion for 2022. GM plans to spend billions over the next few years transitioning to building electric cars and making other changes. (The Verge)

The European Union is trying to convince the United States to ease requirements that electric vehicles must be 'Made in the USA' to qualify for tax credits, even as the two sides near a deal on raw materials, a senior EU official said on Thursday. Washington is providing tax credits of up to $7,500 for consumers buying electric vehicles, but only if final assembly and battery components amounting to at least half of the value are made in North America. (Reuters)

Smart Links

Eight Bay Area households hold more wealth than bottom 50% combined. (SF Gate)

Baidu Hurries to Ready China’s First ChatGPT Equivalent Ahead of Launch. (Wall Street Journal)

EY has been thrown into disarray by an internal war over its plan to split in two after its US boss said the deal would have to be paused. (Financial Times)

Grammarly announces GrammarlyGO, a generative AI tool that can write and rewrite content in a user's style. (9to5Google)