Know someone who would like this newsletter? Forward it to them.

The World

The Supreme Court has voted to overturn abortion rights, a draft opinion shows. "We hold that Roe and Casey must be overruled," Justice Alito writes in an initial majority draft circulated inside the court. “It is time to heed the Constitution and return the issue of abortion to the people’s elected representatives.” (Politico)

India's prime minister kicked off visits to Germany, Denmark, and France, where he will meet with German Chancellor Olaf Scholz and French President Emmanuel Macron. The main agenda item? Making progress on a proposed EU-India free trade agreement, one of several FTAs that Modi wants to secure to attract foreign investment to help the Indian economy recover from the pandemic. But the elephant in the room will be India's neutrality on the Russian war in Ukraine and recent moves to buy cheap Russian oil despite sanctions – policies at odds with EU unity against Russia and long-term plans to wean the continent off Russian energy. Still, don’t expect the Europeans to put too much pressure on the Indians on such a prickly issue. (GZERO Media)

Beijing teeters on edge of Covid lockdown: The pandemic is creeping closer to the halls of power in Beijing as authorities rush to avoid an uncontrolled Shanghai-style Omicron outbreak in China’s capital. Beijing authorities ordered three rounds of citywide PCR tests last week after a cluster of cases was found in the business district of Chaoyang. The capital’s daily case count has remained in double digits for the past seven days. Residents returning to schools and offices on Thursday after this week’s three-day public holiday will have to present a negative Covid test taken within 48 hours. Indoor dining was banned during the holiday in another attempt to slow the outbreak. (Financial Times)

‘We are living in hell’: Pakistan and India suffer extreme spring heatwaves. Turbat, in Pakistan’s Balochistan region, has been suffering through weeks of temperatures that have repeatedly hit almost 50C (122F), unprecedented for this time of year. The heatwave has already had a devastating impact on crops, including wheat and various fruits and vegetables. In India, the yield from wheat crops has dropped by up to 50% in some of the areas worst hit by the extreme temperatures. (The Guardian)

The White House has linked legislation intended to give the US a competitive edge against China to Ukraine’s efforts to repel Russia’s invasion – the latest move to allocate billions of US dollars to fund domestic semiconductor manufacturing. Press secretary Jen Psaki said that what the White House is calling the Bipartisan Innovation Act (BIA) would support development of semiconductor chips in US weapons that Kyiv has used to hinder Russian military advances. (South China Morning Post)

President Biden’s top trade negotiator signaled that relief from U.S. tariffs on China is one option under consideration to confront the fastest inflation in four decades, while cautioning that the duties should be studied in the context of broader economic policy. The tariffs should be examined as part of a look at strategies across the board, including monetary, fiscal and tax policy, U.S. Trade Representative Katherine Tai said. (Bloomberg)

New York City entered a higher risk level for the coronavirus, a troubling reminder that the pandemic is not over. The city moved into the medium, or yellow, risk category for virus transmission as cases continued their steady rise, a development that could trigger the return of public health restrictions, although they are not required to be reinstated at this point. The city is now seeing nearly 2,500 new cases per day, a significant jump from about 600 daily cases in early March. (New York Times)

Economy

The negativity in the U.S. stock market has become so overwhelming that a rebound may not be far off, JPMorgan Chase & Co.’s strategists say. In a note to clients, analysts led by Marko Kolanovic pointed to the closely watched American Association of Individual Investors survey hitting the most bearish mark since early March 2009. That month marked the S&P 500 Index’s bottom from the global financial crisis, and it ended up rallying 23% for the year. (Bloomberg)

Citadel founder Ken Griffin said the Fed will be able to ease off monetary tightening if inflation drops to 4% by year-end. That “will give the Fed much more latitude in policy,” Griffin said. But if it remains near or above the current 8.5%, the central bank “will have to the hit brakes pretty hard,” tipping the economy into recession. (Bloomberg)

The yield on the US 10-year Treasury note touched 3% for the first time in more than three years, as traders prepared for the Fed to raise interest rates again at a time of soaring inflation and slowing growth. It later dipped back to 2.99%, up 0.05 percentage points on the day. (Financial Times)

The stock market is acting like Covid-19 is back. Amid a topsy-turvy day on the stock market, when a big sell-off gave way to a modest rally, one group of companies rallied strongly—the Covid winners. Zoom Video, Pinterest, Peloton, Spotify, Shopify, Roku and Netflix—all of which got pummeled mercilessly in recent months as the pandemic retreated—were each up 5% or more. (The Information)

Goldman Sachs traders generated revenue of more than $100 million on 32 different days in the first three months of the year as volatility ensnared global markets. The Wall Street investment bank’s trading division extended its bumper run during the pandemic, recording more nine-figure daily net gains than in any other quarter over the past decade. (The Times)

Elon Musk is in talks with large investment firms and high net-worth individuals about taking on more financing for his $44 billion acquisition of Twitter and tying up less of his wealth in the deal. (Reuters)

Elon Musk’s Twitter deal rewards risk-taking at Morgan Stanley: Morgan Stanley will take the largest role in a consortium of 12 banks giving Musk $12.5bn in margin loans secured by shares in Tesla, the electric vehicle company he leads. Morgan Stanley agreed to lend $2bn of the sum. The loan is far larger than what Morgan Stanley has offered wealthy individuals in the past. The biggest margin loans it has offered to clients through its private bank have typically been below $1bn. (Financial Times)

Technology

EU regulators charged Apple with breaking competition law by abusing its dominant position in mobile payments to limit rivals’ access to contactless technology, as Brussels stepped up its challenge to one of the world’s largest tech groups. (Financial Times)

Facebook is pulling out of podcasts and plans to remove them altogether from the social-media service starting June 3. It will discontinue both its short-form audio product Soundbites and remove its central audio hub. (Bloomberg)

Anchor co-founder Michael Mignano to leave Spotify. (The Verge)

In a bid to boost Peacock, Universal will send 3 movies straight to streaming: The move is not only an attempt to attract subscribers but an acknowledgment that releasing some films theatrically has become more of a gamble. (New York Times)

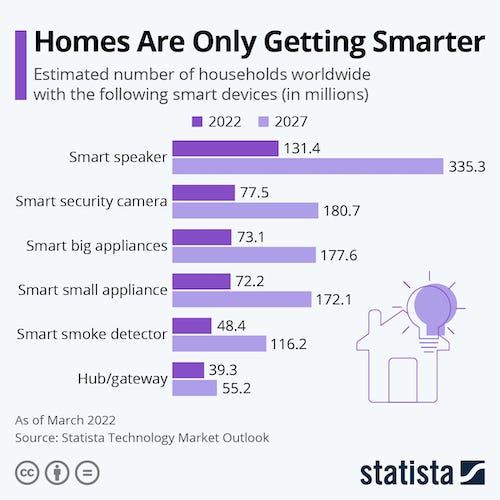

Global spending on Internet of Things products is forecast to reach $1.1 trillion next year: "During the Covid-19 pandemic, homes have become an even greater focal point than before. More and more people want to digitalize their homes, equip them with voice controls, and/or take additional safety measures with IoT technologies. This consumer trend has shielded the Smart Home market against strongly declining sales and the economic downturn in 2020." (Statista)

Smart Links

Did Brexit help Britain help Ukraine? (Politico EU)

Hong Kong’s 142-year-old Star Ferry needs a rescue plan with no tourists in sight. (City Lab)

Spirit board rejects JetBlue takeover offer on antitrust risks. (Reuters)

California population keeps falling, led by coastal losses; inland areas keep growing. (Los Angeles Times)

Meta plots ambitious VR release schedule of 4 headsets by 2024. (The Information)