Know someone who would like this newsletter? Forward it to them.

The World

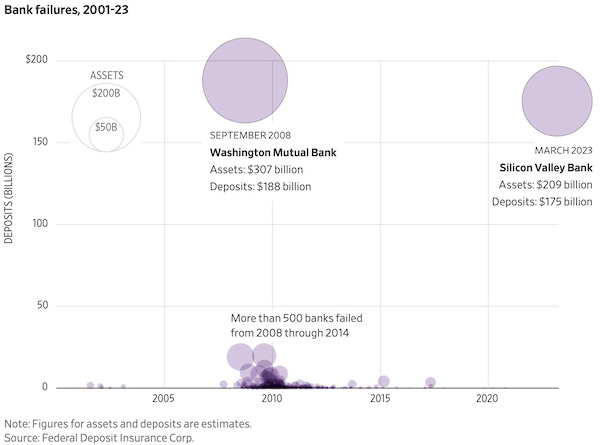

U.S. regulators took control of a second bank Sunday and raced to roll out emergency measures to stem potential spillovers from Friday’s swift collapse of Silicon Valley Bank, backstopping both firms’ uninsured depositors and making more funding available to the banking system. Regulators announced Signature Bank, one of the main banks for cryptocurrency companies, was closed Sunday. The New York bank’s depositors will be made whole, officials said. Officials took the extraordinary step of designating SVB and Signature Bank as a systemic risk to the financial system, which gives regulators flexibility to guarantee uninsured deposits. The Federal Reserve and the Treasury Department also used emergency lending authorities to establish a new facility to help meet demands for withdrawals. Regulators announced the action in a joint statement from Treasury Secretary Janet Yellen, Fed Chair Jerome Powell and Federal Deposit Insurance Corp. Chair Martin Gruenberg. The group said that depositors at SVB will have access to all of their money on Monday. (Wall Street Journal)

Where Were the Regulators as SVB Crashed? Nearly 90% of SVB’s deposits were uninsured, making them more prone to flight in times of trouble since the FDIC doesn’t stand behind them. “A $200 billion bank should not fail because of liquidity,” said Eric Rosengren, who served as president of the Federal Reserve Bank of Boston from 2007 to 2021 and was its top bank regulator before that. “They should have known their portfolio was heavily weighted toward venture capital, and venture-capital firms don’t want to be taking risk with their deposits. So there was a good chance if venture-capital portfolio companies started pulling out funds, they’d do it en masse.” (Wall Street Journal)

‘There’s going to be more': How Washington is bracing for bank fallout

Battle lines are already being drawn over what caused Silicon Valley Bank’s stunning demise. (Politico)

Collapse of Silicon Valley Bank rocks China’s tech start-ups, VC industry: Silicon Valley Bank’s bankruptcy has created a sense of panic among China’s tech start-up and venture capitalists, as the California-based lender was a bridge between US capital and Chinese entrepreneurs. (South China Morning Post)

Etsy warns sellers of delay in processing payments due to Silicon Valley Bank collapse: One affected Etsy seller said the deposits delay would have a “catastrophic” effect on his business. (NBC News)

Silicon Valley Bank employees received bonuses hours before government takeover. (CNBC)

China Plans New Middle East Summit as Diplomatic Role Takes Shape: Xi’s diplomatic initiative shows that Beijing sees a central role for itself as a new power broker in the Middle East, a strategic region where the U.S. has been the most influential outside player for decades. No longer focused exclusively on energy and trade flows, China’s foray into the region’s politics signals a new chapter in competition between Beijing and Washington. The Saudi-Iran deal, hashed out behind closed doors in Beijing last week, takes on some of the most sensitive issues between two countries that have been on opposite sides of proxy conflicts across the Middle East for years. (Wall Street Journal)

China's parliament began considering legislative changes that would slash the time needed to pass laws in emergencies, a move that observers see as preparing for scenarios like a conflict over Taiwan. Proposed amendments to the Legislation Law would let the Standing Committee of the National People's Congress put bills to a vote after just one meeting during an "emergency," shortening a process that usually takes half a year or more. (Nikkei Asia Review)

Tennessee Governor Seeks To Make One Of The Nation’s Best Tax Climates Even More Hospitable: Lawmakers and governors in nearly half of the states have cut income tax rates over the past two years and more are now following suit. Before the second month of 2023 came to a close, noteworthy income tax cuts had already been introduced and passed in a number of states. A couple of reasons help explain why tax relief has been enacted in most states in recent years and why governors like Jim Justice are so eager to get in on the action. One reason is that states are financially well-positioned to do so, with many sitting on sizable budget surpluses. Another motivating factor is that lawmakers in states that already have a low overall tax burden and hospitable business tax climate — places like Florida, Texas, North Carolina, and Tennessee — continue to pursue further reforms that will provide more relief to taxpayers and make their tax codes even more conducive to job creation than they already are. (Forbes)

California was bracing for another round of rain beginning today as officials tried to assess the damage from severe flooding along the Central Coast and Central Valley, which left scores stranded and left whole blocks under water. Yet another atmospheric river will bring new flood concerns to Northern California beginning Monday and continuing through Tuesday night. The Bay Area is now seeing bands of rain showers and thunderstorms, but “the focus is going to be on the next atmospheric river that arrives Monday evening,” said Patrick Ayd, a meterologist with the National Weather Service. (Los Angeles Times)

What is an atmospheric river? Storms associated with atmospheric rivers have dumped record amounts of rain and snow in California this winter, resulting in flooding and other hazards. The big picture: Atmospheric rivers direct tropical moisture, often from more than 1,500 miles away, toward the Golden State, where it is wrung out in the form of heavy precipitation. Atmospheric rivers are long, narrow highways of moisture, typically located at about 10,000 to 15,000 feet above the surface. They can travel thousands of miles and are responsible for 30-50% of the wet season precipitation along the West Coast of the U.S. A strong atmospheric river can transport an amount of water vapor that is “roughly equivalent to 7.5–15 times the average flow of liquid water at the mouth of the Mississippi River,” NOAA has found. Scientists have only recently gained a greater understanding of the role that atmospheric rivers play in West Coast storm events, and observed them affecting other regions of the world as well. (Axios)

Economy

Saudi Aramco reported record profits of $161bn in 2022 and increased its quarterly payout to shareholders to almost $20bn as the largely state-owned oil company cashed in on a tumultuous year in energy markets. The Saudi Arabian producer said that it sold more oil than in 2021, improved refining margins and benefited from strong crude prices, which helped net income to rise 47 per cent to its highest since the company began publishing results after listing in 2019. The huge profits, which chief executive Amin Nasser described as “probably the highest net income ever reported in the corporate world”, complete a record set of earnings for the world’s biggest oil and gas companies after fossil fuel prices soared following Russia’s invasion of Ukraine. (Financial Times)

This oil rich kingdom unveiled a new international airline called Riyadh Air, aiming to compete with a handful of other Mideast carriers that have used their geography to build world-class airlines and attract business travelers and tourists. Saudi Arabia’s sovereign-wealth fund, the Public Investment Fund, is close to committing to a big order of Boeing jets to underpin the new airline. Saudi Arabia first disclosed plans in 2021 to create a new regionally based, international airline. Mideast carriers like Dubai’s Emirates Airline, Qatar Airways, and Bahrain’s Gulf Air have for years taken advantage of the location of their home airports to build themselves into long-haul carriers for travelers between Asia and Europe and onward to and from North America. (Wall Street Journal)

A mountain of interest rate-driven debt: Last year, a group of 58 developed and emerging economies accounting for over 90% of global GDP surveyed by The Economist were on the hook for a whopping $13 trillion just in interest payments on their debt, up an astounding 25% from 2021. And this is on top of all the additional money that many countries borrowed to spend on stimulus programs during the pandemic. Everyone now owes a lot more than they signed up for at the micro and macro levels: Mortgage rates in the US have skyrocketed, corporate debt has ballooned in Hungary, and highly indebted countries like Ghana are now in even bigger trouble. So long as inflation forces central banks to keep interest rates high, access to capital will be tight for everyone: people looking to finance homes and cars, countries seeking relief from their massive debt burdens, and companies looking to raise money. And as the collapse of Silicon Valley Bank on Friday showed, this kind of risk aversion on the part of investors can — when the stars misalign — threaten to unleash broader financial chaos. (GZERO Media)

Three global cities are pulling ahead since the peak of the pandemic: Miami, Dubai and Singapore boom by welcoming those chased out of rival international hubs. (Financial Times)

China kept its current central bank governor and finance minister in a surprise move at the country's annual parliament on Sunday, alongside a slate of trusted lieutenants installed for President Xi Jinping's third term. People's Bank of China Gov. Yi Gang was nominated to retain his post. That defied expectations that Zhu Hexin, head of state-owned Citic Group, would take over from Yi, a respected U.S.-educated economist who has been leading the central bank since 2018. (Nikkei Asia Review)

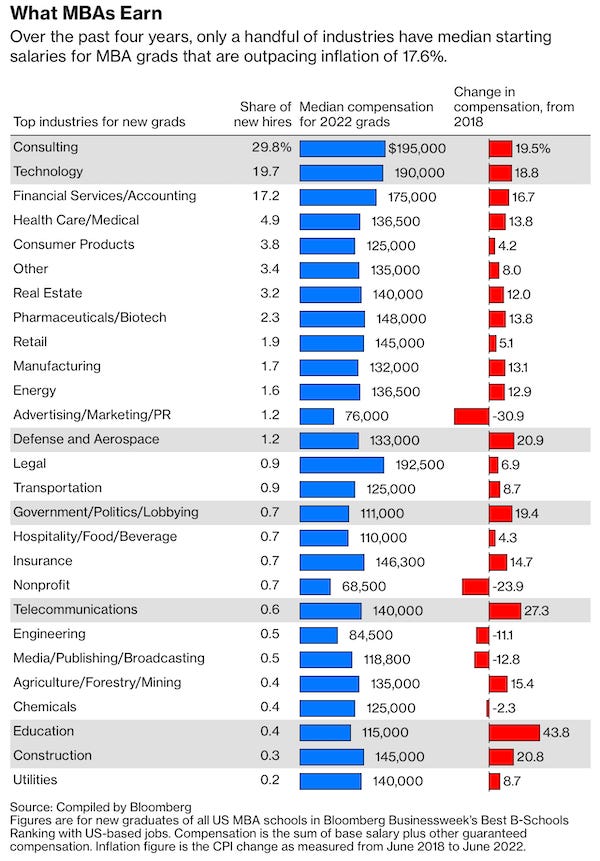

The Promise of Higher Pay Woos MBAs, Yet Earnings Haven’t Kept Up With Inflation: The reasons prospective MBA students consider attending business school are multifaceted, but one theme consistently stands above the rest: higher salaries. When surveyed last year by Bloomberg Businessweek as part of the Best B-Schools rankings, 73.3% of second-year students at US schools selected increased compensation as one of the top five factors (out of 13 choices, which include to develop better quantitative skills, to build a professional network and to become a better leader) they considered when deciding whether to pursue an MBA. The responses of alumni six to eight years out of school were similar. All the stakeholders we survey—students, alumni and employers—collectively say compensation is more important than networking or even learning. That’s not surprising, given that the median gain in salary from students’ pre-MBA jobs to their first jobs out of business school in 2022 was $85,000. The data below sheds light on 2022 MBA grads. Two-thirds of new hires ended up in either consulting, tech or finance, which are among the highest-paid industries. (Bloomberg Businessweek)

Technology

Apple, known for its stability at the top, is facing a new challenge: an unprecedented level of turnover in its executive ranks. Over a stretch that began in 2H22, Apple has lost about a dozen high-ranking executives. Most of these people carried the title of vice president, which is just below the senior vice president level that reports to Chief Executive Officer Tim Cook. They are some of the most important figures at Apple, responsible for day-to-day operation of many core functions. The departures included vice presidents overseeing such fields as industrial design, the online store, information systems, Apple’s cloud efforts, aspects of hardware and software engineering, privacy matters, sales in emerging markets, subscription services and procurement. In all, that’s 11 key people — a far higher amount of turnover than we’ve seen in recent memory. (Bloomberg)

Cook bets on Apple’s mixed-reality headset to secure his legacy. After seven years in development — twice as long as the iPhone — the tech giant is widely expected to unveil a headset featuring both virtual and augmented reality as soon as June. The stakes are high for Cook. The headset will be Apple’s first new computing platform to have been developed entirely under his leadership. The iPhone, iPad and even Watch were all originally conceived under Apple’s co-founder Steve Jobs, who died in 2011. (Financial Times)

Chip sales that have declined across many customer segments are still enjoying one area of rising demand: cars. Growing sales of electric vehicles—which tend to use more semiconductors than their gas-powered counterparts—coupled with greater automation of all vehicles, have kept producers of chips for cars busy. (Wall Street Journal)

Why ChatGPT and AI are taking over the cold call, according to Salesforce leader: The launch of ChatGPT has started a wave of technology companies looking to integrate generative AI into their products and apps. Salesforce is rolling out a new product that uses OpenAI’s advanced AI models to help salespeople, customer service workers, developers and others remove mundane tasks from their workday. One job burden in particular being removed is writing “dreaded” sales emails, according to Salesforce Service Cloud CEO Clara Shih. (CNBC)

Fights Over Rural America’s Phone Poles Slow Internet Rollout: The U.S. plans to spend at least $60 billion in the next decade to ensure every American household has high-speed internet. An old-fashioned obstacle stands in the way: utility poles. Getting everyone the same service city dwellers enjoy generally means stretching fiber-optic cable to homes, farms and ranches in rural areas. Many of these places already have utility poles carrying electric or telephone wires. The poles are owned by electric or phone companies that often aren’t getting public money to build out broadband, triggering skirmishes that some internet providers blame for slowing needed upgrades. (Wall Street Journal)

Smart Links

Used Rolexes Are Beating the Stock Market. (Wall Street Journal)

Savers Pile Money Into Bank CDs as Rates Top 5%. (Wall Street Journal)

Want an Upgrade? Bid Your Way to First Class With These Airline Auction Strategies. (Wall Street Journal)

London Has Become the Land of the £1 Million Home. (Wall Street Journal)

FBI, Pentagon helped research facial recognition for street cameras, drones. (Washington Post)