Know someone who would like this newsletter? Forward it to them.

The World

Regional Banks Slammed by Fear of a Broader Financial Crisis: The unexpected seizure of two banks in three days by regulators intensified fears of a broader financial crisis, sending the stocks of more than two dozen banks into free fall on Monday, even as President Biden reassured Americans that the banking system was resilient and that customers’ money was safe. Banks of various sizes in different parts of the country — from San Francisco-based First Republic Bank to Salt Lake City-based Zions Bank — found themselves battling market turmoil as customers rushed to withdraw their deposits and investors, worried about more runs, dumped bank stocks. Biden said that the government was responding decisively to the collapse of Silicon Valley Bank and Signature Bank in ways that would protect depositors without rewarding risk-taking executives and investors. (New York Times)

Startup founders were relieved to start getting access to their money at Silicon Valley Bank, as the entrepreneurs and venture investors said the lender’s collapse would drive changes in the industry’s financial practices. Venture investors said that they remain shaken by the speed of the bank’s collapse and that it should serve as a wake-up call for founders to reassess their cash and risk-management practices amid the most severe downturn the tech industry has suffered in over a decade. (Wall Street Journal)

The Federal Reserve’s aggressive year-long fight against inflation has hit its first major roadblock with the collapse of two large banks that have cast a pall over the U.S. financial system. The crisis, which has already prompted a large response from the Fed and other regulators in the form of a new special lending facility and measures to make depositors of the failed banks whole, is raising questions about whether the central bank can continue to hiking interest rates in the face of an increasingly fragile financial system. “The Fed has now lost the luxury of being almost single-mindedly focused on the fight against inflation,” said Frances Donald, global chief economist and strategist for Manulife Investment Management. “There was always going to be an inflection point when the costs of the rate hikes outweighed the benefits. The Fed has to consider that we’re much closer to that moment than before.” (Washington Post)

Global bond markets have declared that the steepest global monetary tightening campaign in a generation is as good as done. Benchmark short-end bond yields have crashed below their economy’s cash rates across most of the developed world in the few sessions since the collapse of Silicon Valley Bank. (Bloomberg)

Republicans and Democrats alike have wasted no time turning the collapse of Silicon Valley Bank into a political football, seizing on the themes already animating each party's economic message heading into 2024. The fallout from SVB's failure appears to be limited, but neither party can risk underestimating the scale of a potential "bailout" backlash. President Biden and many congressional Democrats have their eyes fixed on one juicy culprit — former President Trump and his 2018 rollback of parts of the Dodd-Frank Act, which provided regulatory relief for midsized banks such as SVB. (Axios)

Barney Frank blames crypto panic for his bank’s collapse. Elizabeth Warren blames Trump. The rift between Frank and Warren is just a preview of what’s to come as Democrats sort out positions on how to respond to the latest banking crisis, which led to a weekend bailout of depositors at Silicon Valley Bank and Signature. Some like Warren want Washington to restore the tougher regulations that were rolled back in 2018. Some Democrats, like Frank, say the 2018 law isn’t the problem. A number of moderate Democrats still in Congress helped write the 2018 legislation, including those facing reelection in 2024. (Politico)

This action effectively means the $250,000 FDIC limit is meaningless: all deposits in any bank are presumably insured by the full faith and credit of the United States. The reasoning for this move is the same as what motivated the creation of the FDIC in the first place: given that most businesses need more than $250,000 in working capital, the rational response of any business in any sector to Silicon Valley Bank depositors losing their money would be to shift their accounts to the banks which have already been deemed too big to fail (JPMorgan Chase, Bank of America, Wells Fargo, and Citibank); this would mean bank runs on everyone else. The federal government’s action is, in my estimation, the right thing to do for this moment in time. There will, though, be long-term consequences for fundamentally changing the nature of a bank: remember, depositors are a bank’s creditors, who are compensated for lending money to the bank; if there is no risk in lending that money, why should depositors make anything? Banks, meanwhile, are now motivated to pursue even riskier strategies, knowing that depositors will be safe; the answer will almost certainly be far more stringent regulation on small banks, of the sort imposed on the big four after 2008. That, in turn, will mean tighter credit and more fees for consumers, in addition to what will be a big increase in FDIC insurance premiums. And, while taxpayers may not be directly infusing money into failing banks, taking on all of those low-interest rate securities is real opportunity cost. To put it another way, before the events of last week the U.S. benefited from a banking trust dividend: businesses technically should have been worried about money that exceeded the $250,000 insurance limit, but in practice few gave it much concern. This made their operations more efficient, and made money more widely available for banks to lend. Regional banks, meanwhile, got away with lower capital requirements and less regulation, making it easier to extend credit and offer bespoke services. The FDIC, meanwhile, charged relatively low fees of member banks because it was only insuring $250,000 per account, even though its presence made the overall system much safer and more reliable for accounts of all sizes. That trust dividend is now gone, and the costs of replacing trust with explicit rules and regulations will accumulate forevermore. (Statechery)

Chinese leader Xi Jinping plans to speak with Ukrainian President Volodymyr Zelensky for the first time since the start of the Ukraine war, likely after he visits Moscow next week to meet with Russian President Vladimir Putin, according to people familiar with the matter. The meetings with Messrs. Putin and Zelensky, the latter of which is expected to take place virtually, reflect Beijing’s effort to play a more active role in mediating an end to the war in Ukraine, some of the people said. Mr. Xi is considering visiting other European countries as part of his trip to Russia, though his full itinerary has yet to be confirmed. (Wall Street Journal)

China will resume issuing visas to tourists and other foreigners, a significant step in the country’s move to rejoin the world and leave its stringent Covid restrictions behind. The shift comes into force from Wednesday, China’s embassy in the US said in a statement. It will also see visa-free entry into Guangdong province resumed for foreigners in groups from Hong Kong and Macau, and for those on cruise ships stopping in Shanghai. (Bloomberg)

China's Xi wants bigger global role after Saudi-Iran deal: President Xi Jinping called Monday for China to play a bigger role in managing global affairs after Beijing scored a diplomatic coup as the host of talks that produced an agreement by Saudi Arabia and Iran to reopen diplomatic relations. (Associated Press)

President Biden appeared at a Naval shipyard with his British and Australian counterparts to announce a major new plan to supply Australia with nuclear-powered submarines in what amounts to a direct counter to China’s growing influence in the region. Standing with British Prime Minister Rishi Sunak and Australian Prime Minister Anthony Albanese, Biden unveiled details of the arrangement at a time of rising tensions with China and amid a global realignment that is triggering dramatic increases in military spending in the wake of Russia’s invasion of Ukraine. (Washington Post)

South Korea should build nuclear weapons to bolster its defenses against North Korea, even at the risk of international repercussions, the mayor of its capital city said, arguing that the country cannot be bound by the goal of denuclearisation. In an exclusive interview with Reuters, Seoul Mayor Oh Se-hoon added new fuel to a growing debate over how South Korea should arm itself as the North races to perfect its capability to strike the South with tactical nuclear weapons. (Reuters)

How Biden Got From ‘No More Drilling’ to Backing a Huge Project in Alaska: As a candidate, Joseph R. Biden promised voters worried about the warming planet “No more drilling on federal lands, period. Period, period, period.” On Monday, President Biden approved an enormous $8 billion plan to extract 600 million barrels of oil from pristine federal land in Alaska. The distance between Mr. Biden’s campaign pledge and his blessing on that plan, known as the Willow project, is explained by a global energy crisis, intense pressure from Alaska lawmakers (including the state’s lone Democratic House member), a looming election year and a complicated legal landscape that government lawyers said left few choices for Mr. Biden. (New York Times)

Economy

The Group of Seven major economies will call for the creation of groupwide supply chains for strategically important goods to be included in their joint document issued at the May leaders summit in Hiroshima. The idea is to expand various international supply chain arrangements being established individually by Japan and the U.S., and the U.S. and Europe, for example, to a cover the entire G-7. (Nikkei Asia Review)

US minerals industries are booming. Here’s why. A recent set of sweeping US laws have kicked off a boom in proposals for new mining operations, minerals processing facilities, and battery plants, laying the foundation for domestic supply chains that could support rapid growth in electric vehicles and other clean technologies. But some experts worry that the laws’ requirements are so stringent they could have the unintended effect of actually slowing the shift to cleaner technologies.David Turk, deputy secretary of the Department of Energy, spoke with MIT Technology Review about what a US mining resurgence means, why it’s crucial to build up supply chains, and how the Biden administration is striving to strike the right balance on the attendant concerns. (MIT Technology Review)

China set to tighten grip over global cobalt supply as price hits 32-month low. (Financial Times)

EY US boss signaled wide-ranging concerns over split: Julie Boland tells partners there are questions about how to protect the audit business and profit targets for consulting. (Financial Times)

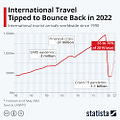

International Travel Bounced Back Strongly in 2022. (Statista)

Technology

A California appeals court reversed most of a ruling invalidating Proposition 22, the state’s 2020 voter-approved gig economy law allowing giant ride-hailing and delivery companies like Uber and Lyft to classify their workers as independent contractors rather than employees. The 1st District Court of Appeal determined Proposition 22 should stand, disagreeing with a 2021 ruling finding that central provisions of the law conflicted with the state Constitution, rendering the law unenforceable, and tossing it out in its entirety. However, the appeals court struck down a provision of the law restricting certain legislative amendments. (Los Angeles Times)

Microsoft Strung Together Tens of Thousands of Chips in a Pricey Supercomputer for OpenAI: Now the software maker’s cloud technology supports AI products for the company and customers while it puts together a successor. (Bloomberg)

Google employees are already internally testing a smarter version of its chatbot called 'Big Bard'. Google has asked staff to test and improve its internal chatbot, Bard, before it's launched to the public, but many employees are already playing with a superior version. Googlers built "Big Bard," as the company refers to it internally, on the same language model as Bard, known as LaMDA, but with seemingly larger parameters that make it appear more intelligent. Insider viewed examples of users asking both versions similar questions, and Big Bard produced richer and more humanlike responses. It's also generally chattier, more informal, and prone to swearing. The AI race shows no sign of slowing. Andreas Braun, the CTO of Microsoft Germany, just announced that OpenAI will release the next version of its language model, GPT-4, next week. GPT-4 will be multimodal, meaning it will also encompass video, images, and audio. (Insider)

Meta says it is winding down its work on NFTs “for now” to focus on other ways of supporting creators, people, and businesses. (The Block)

Courses in the metaverse struggle to compete with real world: The Vienna University of Economics and Business (WU) has offered a tantalising prospect to people who want to learn but don’t like to leave the house: join us ‘virtually, for a postgraduate course in the metaverse. Setting up the course “provides us with greater reach, making the course more global”, explains Barbara Stöttinger, dean of WU’s executive academy. However, she is quick to add: “Vienna is a great location so coming to campus is still pretty attractive to most of our students”. And this is the problem at the heart of why many business schools have been reluctant to enter the metaverse for course tuition: studying in the real world has its advantages. Meanwhile, the metaverse has been caught in an extreme example of a ‘hype cycle’. This is where wild enthusiasm about a new technology turns to widespread rejection, as its reality fails to live up to what is claimed for it. (Financial Times)

Silicon Valley startup accelerator Y Combinator won’t raise another continuity fund, which backs mature private tech companies, two people familiar with the matter said. The decision comes during a sharp pullback in venture funding, particularly for late stage companies, in which investors have been reluctant to write big checks for startups after the value of comparable public tech companies have fallen. The move was not connected to the recent implosion of Silicon Valley Bank. (The Information)

Smart Links

Dropout rates have ticked up in some states. (Chalkbeat)

As Supreme Court Considers Student Loan Forgiveness, States May Expand Their Programs. (Stateline.org)

Net-Zero Homes Aren’t Just for Millionaires: A Colorado initiative is betting that the cheapest housing will also be the greenest. (The Atlantic)

Chick-fil-A Wants to Serve Its Chicken Sandwiches in Asia and Europe. (Wall Street Journal)

Here are the Meta jobs expected to be cut. (Washington Post)

Oscars viewership jumps to 3-year high. (Axios)