Know someone who would like this newsletter? Forward it to them.

The World

Russian state-backed energy group Gazprom announced it would halve the flow of natural gas to Europe via the Nord Stream 1 pipeline, sending prices in Europe soaring to five times what they were this time last year. The European Union meanwhile agreed to emergency measures to cut gas consumption by 15% as further cuts in supply are expected, although some member states were exempted after initial objections. (Financial Times, Reuters)

EU deal to reduce consumption highlights divisions within the bloc: EU Energy ministers have signed off on a deal to reduce gas consumption by 15% but the agreement is littered with exemptions and derogations for a number of member states. (Deutsche Welle)

Germany rethinks nuclear power exit due to threat of winter energy crunch. (Financial Times)

Slovakia may consider giving Ukraine Russian-built warplanes. (Associated Press)

The U.S. and South Korea will stage full-fledged joint military exercises for the first time in four years since the drills were put on hold to open up dialogue with North Korea. (Nikkei Asia Review)

U.S. says Biden-Xi call on Thursday expected to cover Taiwan tensions, Ukraine. (Reuters)

China sends troops and tanks to Russia ahead of next month’s military games. Events will be held across 12 countries including China and Venezuela. (South China Morning Post)

Taiwan’s capital staged air raid drills and its military mobilized for routine defense exercises, coinciding with concerns over a forceful Chinese response to a possible visit to the island by U.S. Speaker of the House Nancy Pelosi. (ABC News)

Podcast: After years of fighting insurgent forces in Iraq and Afghanistan, the U.S. military has shifted its focus to technologically-advanced opponents, especially China. The Marine Corps is taking the lead. (NPR)

The Economic Effects of Extreme Heat in China: As heatwaves burn through the country, China will suffer the economic effects of extreme heat. Some cities are on high alert for temperatures above 95 degrees Fahrenheit, while many cities across the nation are likely to surpass 104 degrees F. This extreme heat will have economic impacts through power rationing, reduced crop yield, and effects on delivery and other outdoor workers. A McKinsey study found that climate change in China, including extreme heat waves, is likely to reduce crop yields of wheat, corn, and rice by 10% each year. (The Diplomat, McKinsey)

Chinese spending on belt and road projects remained low in first six months, report says. Total financing and investment was US$28.4 billion from January to June, down 40 per cent from 2019. There was no Chinese spending in Russia, Sri Lanka and Egypt in this period, according to Fudan University’s GFDC. (South China Morning Post)

At least five protesters were killed and 50 others injured in the Congolese city of Goma during the second day of demonstrations against the U.N. peacekeepers' perceived inability to safeguard the population. Thousands of people have been displaced in Congo in recent months due to clashes between armed groups, most prominently the M23 rebels, amid a slow process of withdrawal of the U.N. peacekeeping mission from the region. (Reuters)

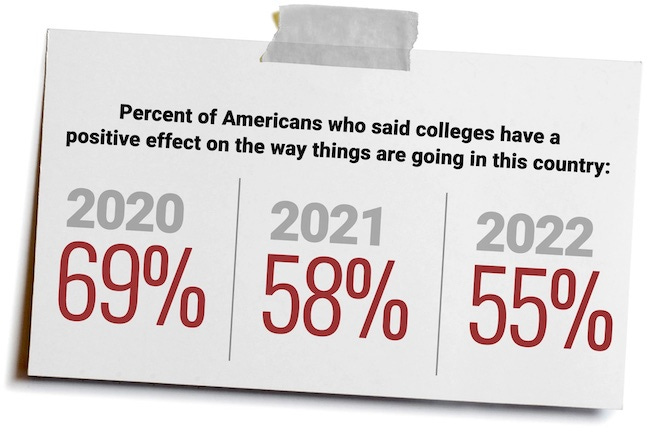

Americans’ Confidence in Higher Ed Drops Sharply: Partisan strife and concerns about cost take their toll. (Chronicle of Higher Ed)

Economy

Unilever, Coca-Cola and McDonald’s laid bare the impact of global inflation, responding to higher costs with price increases that will heap more pressure on households. The warnings from some of the world’s largest consumer goods groups about the extent of price increases on basic goods followed a profits downgrade from Walmart, the US retailer, which said food and fuel inflation was “affecting how customers spend”. As inflation reached its highest level in decades in many countries, Amazon increased prices for its Prime membership scheme across its major European markets. The online retailer blamed “increased inflation and operating costs” while Unilever warned of a “truly unprecedented cost landscape”. (Financial Times)

Shoppers Spend But Don’t Splurge, Clouding US Recession Call. (Bloomberg)

Low-cost cities with strong economies fared well in the second quarter as high prices and rising mortgage rates caused a swift slowdown in the housing market. As remote or hybrid work schedules have become more common, households are willing to relocate for cheaper housing or a better quality of life. That migration helped push small, affordable markets to the top of the The Wall Street Journal/Realtor.com Emerging Housing Markets Index in the second quarter. The top 20 cities in the ranking have an average population size of about 400,000. (Wall Street Journal)

New York Renters Are Now Paying the Price for the ‘Covid Discount’: More than 40 percent of the available units in Manhattan currently come from tenants priced out of apartments they leased in 2020 and 2021. (New York Times)

Venture capitalists are pouring money into digital currency and blockchain startups at a pace that's set to outstrip last year's record. In the first half of the year, VCs bet $17.5 billion on such firms.That puts investment on course to top the record $26.9 billion raised last year. (Reuters)

Early-round unicorns still happening despite market pullback: Even with a drop in venture funding and slashed valuations, early-stage companies are still being minted as unicorns at a breakneck pace. Last year saw a record 109 companies reach unicorn status after an early-stage funding round. There has been almost no drop in that record pace so far this year. (Crunchbase)

Technology

Microsoft reassures investors with confident full-year forecast, as the software company says the macro environment ‘plays to our strength’ despite weaker PC market and stronger US dollar. (Financial Times)

Google parent Alphabet’s revenue growth falls to slowest pace in two years, reflecting the impact of dour sentiment for online ads and stronger US dollar. (Financial Times)

Amazon will raise fees for its delivery and streaming service Prime in Europe by up to 43% a year, as it moves to counter higher costs days before it reports quarterly financial results. (Reuters)

Twitter to hold vote on Musk merger on Sept. 13, while adding it significantly slowed hiring during the second quarter. (CNBC)

Shopify Says It Will Lay Off 10% of Workers, Sending Shares Lower. (Wall Street Journal)

Executives of tech companies operating in both the U.S. and China are taking steps to break apart their businesses to avoid the kind of political and regulatory pressure facing TikTok and its Chinese parent, ByteDance. The latest example of U.S.-China corporate decoupling involves two developers of self-driving trucks, both founded in California, that test prototypes and employ software and hardware engineers in both countries. Plus, which was valued at nearly $3.3 billion in a private fundraising earlier this year, is discussing a deal in which its largest Chinese shareholder would significantly reduce its stake and voting control over the company’s U.S. unit while simultaneously taking a majority stake in its China unit, according to two people with knowledge of the previously unreported talks. (The Information)

Senate Bill to Boost Chip Production, Advanced Technology Set to Move Ahead: Supporters say measures needed for U.S. to maintain competitive edge, while foes say semiconductor firms should pay their own way. (Wall Street Journal)

Leap Seconds: Google, Microsoft, Meta and Amazon launched a public effort Monday to scrap the leap second, an occasional extra tick that keeps clocks in sync with the Earth's actual rotation. US and French timekeeping authorities concur. Since 1972, the world's timekeeping authorities have added a leap second 27 times to the global clock known as the International Atomic Time (TAI). Instead of 23:59:59 changing to 0:0:0 at midnight, an extra 23:59:60 is tucked in. That causes a lot of indigestion for computers, which rely on a network of precise timekeeping servers to schedule events and to record the exact sequence of activities like adding data to a database. The temporal tweak causes more problems -- like internet outages -- than benefits, they say. And dealing with leap seconds ultimately is futile, the group argues, since the Earth's rotational speed hasn't actually changed much historically. (Cnet)

Documents Show How Roblox Planned to Bend to Chinese Censorship: Filtering games. Blocking maps with Taiwan. Handling "historical facts." Roblox was prepared to go all in on Chinese censorship, according to newly released internal documents. (Vice)

Smart Links

Millennials’ average net worth more than doubled during the pandemic, jumping to $127,793 during 1Q22. (CNBC)

Rise in gasoline prices threatens social stability and food security in Latin America. (CNN)

Chipotle price hikes drive profit growth – and the chain says more increases are coming. (CNBC)

How governments seize millions in cryptocurrency. (MIT Technology Review)

‘Weekend warriors’ can make up for missed exercise during week. (Harvard Chan School of Public Health)

Facebook will let creators make money on videos with licensed music. (Axios)

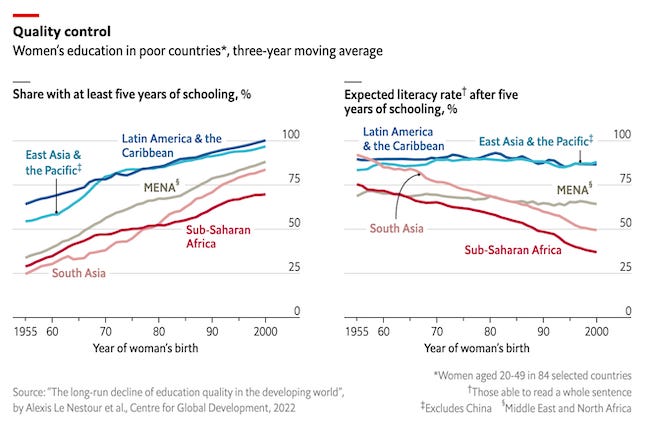

Schools in poor countries are failing women. More children are enrolled than ever. But they are not learning much. (The Economist)