Know someone who would like this newsletter? Forward it to them.

The World

For the last two decades, incomes in poorer countries were catching up to rich countries. The pandemic economy of the 2020s may reverse the trend, the World Bank warns in a new report. In its Global Economic Prospects report, the development organization lays out a constellation of factors that are making the economic impact of the pandemic more lasting and severe in countries that were poorer to begin with. They are less likely to have effective mechanisms to obtain and rapidly distribute vaccines: They tend to have more limited access to debt markets and therefore less capacity for large-scale government borrowing to cushion the economic pain; inflation tends to be more of a problem; and for rich countries, higher food prices are an annoyance; for poor countries, they can cause mass starvation. (Axios, World Bank)

Chinese President Xi Jinping warned nations against protectionism, well as "hegemony and bullying," urging countries to work cooperatively on global challenges. Without accusing any individual country, Xi also warned against the "fanning of ideological antagonism and the politicizing of economic, scientific and technological issues." Xi was speaking at an online meeting of the World Economic Forum, which would normally take place in Davos. "History has proved time and time again that confrontation does not solve problems — it only invites catastrophic consequences," Xi said. "Protectionism and unilateralism can protect no one. They only hurt the interests of others, as well as one's own." (Deutsche Welle)

China's population grows 0.034% in 2021, slowest in six decades: China's population growth rate sunk to another record low in 2021, underscoring the ticking demographic time bomb that could reverse its growth in purchasing power and production in the near future, and eroding the source of strength that has made it the world's second-largest economy after the U.S. China’s overall population increased by about 480,000 people – to 1.4126 billion in 2021, from 1.412 billion a year earlier. Chinese mothers gave birth to 10.62 million babies last year, an 11.5% drop from 12 million in 2020. The national birth rate fell to a record low of 7.52 births for every 1,000 people in 2021, from 8.52 in 2020. (Nikkei Asia Review, South China Morning Post)

The U.K. is supplying Ukraine with anti-tank weapons, the British defense secretary said. “We have taken the decision to supply Ukraine with light anti-armor defensive weapon systems,” Ben Wallace told the House of Commons, adding that the first of these systems was delivered on Monday. “They are not strategic weapons and pose no threat to Russia. They are to use in self-defense.” Wallace said the decision to send the weapons was in response to “the increasingly threatening behavior from Russia.” (Politico EU)

Indonesia's new capital city is set to be called 'Nusantara,' with the country's House of Representatives scheduled to vote as early as today on a bill to shift the government from Jakarta to a site on the island of Borneo. (Nikkei Asia Review)

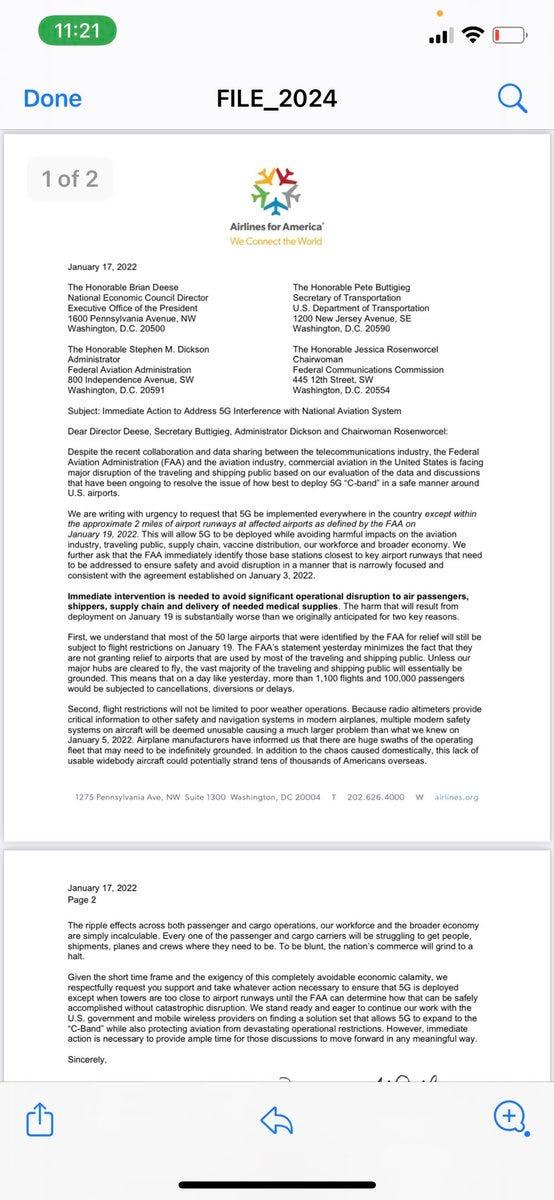

The CEOs of leading U.S. air cargo and passenger carriers warned the Biden administration there could be "catastrophic disruption" after AT&T and Verizon deploy a new 5G service this week. They said in a letter to Transportation Secretary Pete Buttigieg and other top federal officials ahead of the C-Band 5G service's deployment Wednesday that "the nation's commerce will grind to a halt" and "could potentially strand tens of thousands of Americans overseas." (Axios)

Berlin is turning into a COVID hot spot: Long waits at testing centers, empty shops and soon reduced service on public transport as infection numbers are exploding and infrastructure challenges are piling up. (Deutsche Welle)

French COVID hospitalizations see biggest jump since Nov 2020. (Reuters)

Evidence is building that specialized immune cells called T cells can recognize variants of the SARS-CoV-2 virus, including Omicron, even when antibodies can’t. In people who have been infected or vaccinated, neutralizing antibodies bind to a handful of regions on the SARS-CoV-2 spike protein. When those sites mutate, antibodies can’t recognize the virus, and protection fades. T cells, however, are more resilient. By killing infected cells, T cells can limit the spread of infection — and potentially reduce the chance of serious illness. The findings raise the question of whether researchers assessing the potential efficacy of COVID-19 vaccines should look at T-cell responses, and not just the levels of antibodies they trigger. (Nature)

China lockdowns hit factories and ports in the latest knock to supply chains. Toyota, Samsung and Volkswagen are among companies with production affected as economists warn of more challenging bottlenecks. (Wall Street Journal)

Military brass, judges among professions at new image lows: Gallup's annual rating of the honesty and ethics of various professions finds five of the 22 occupations rated this year at new lows in public esteem. While the majority of Americans continue to believe military officers have high ethics (61%), the score is down 10 percentage points since it was last measured, in 2017. TV reporters' ethics rating has fallen nine points to 14% over the same period, and judges' has declined five points to 38%. While down several points since 2020, the perceived ethics of clergy (36%) and grade-school teachers (64%) are just a point or two below their previous all-time lows. (Gallup)

Economy

If the Russia-Ukraine crisis escalates, gas prices in Europe – which soared to highs last year – could surge further, research firm Capital Economics said in a note over the weekend. “It’s a very tight gas market ... and there’s no question that this sense of imminent crisis building with Russia and Ukraine is also hanging over the market, particularly since Russia does provide about 35% of Europe’s gas,” energy expert Dan Yergin said. As it is, gas supplies from Russia were already lower than usual, Jefferies pointed out in a note on Sunday. (CNBC)

To combat inflation realities, businesses are turning to a mix of price increases and "shrinkflation" — cutting the amount you get, not the price you pay. Domino’s Pizza CEO Ritch Allison said the chain plans to reduce the number of chicken wings in its $7.99 deal from 10 to eight. Facing food-cost increases of 8%–10%, Domino’s also plans to eliminate its $7.99 pizza deal for call-in orders, making it online only amid labor shortages. (Axios)

China GDP: The economy beat the 2021 growth target, but a slowdown underlined in 4Q21. China’s economy grew by 8.1% in 2021 against an economic growth target of ‘above 6%’ for 2021. The People’s Bank of China also cut its two major policy rates by 10 basis points, further evidence of Beijing’s intention to stabilize the growth in 2022. (South China Morning Post)

Rolls-Royce, Bentley, BMW sales surge as cheaper brands lag behind: A surge in luxury-car sales and the shifting of scarce semiconductors to the most profitable vehicles helped many auto makers achieve robust profits last year, even as sales of mainstream vehicles lagged behind and supply-chain disruptions crippled car production. The most luxurious brands such as Rolls-Royce, Bentley, Porsche and BMW have reported record sales, as a young generation of luxury-car consumers went on a shopping spree last year. (Wall Street Journal)

Beyond Meat has become one of the most shorted companies on the US stock market as investors fret over weaker sales and skepticism grows over the plant-based meat boom. Short-positions on Beyond Meat shares have increased 40% since late October, when the California-based company issued a revenue warning. (Financial Times)

UBS targets lower-end rich with advice by device: UBS is heading down the wealth curve to open up a bigger profit pool—people who have $250,000 to $2 million to invest but don't want to trade their own portfolios or hire a financial adviser. The target audience is the roughly two million people who already have workplace stock and retirement programs managed by UBS but little other contact. That strategy puts it in direct competition with mass-market rivals such as Fidelity Investments and Charles Schwab, as well as Morgan Stanley's wealth management unit. (Wall Street Journal)

A jump in real yields — the return bond investors can expect once inflation is taken into account — has jolted markets in early 2022 and is behind a pullback in high-flying technology stocks. Real yields have risen more than yields on ordinary US Treasuries so far in 2022. That means the gap between the two — which is known as break-evens and is a closely followed gauge of investors’ inflation expectations — has fallen slightly. (Financial Times)

Technology

Fiber-optic cable, which carries 95% of the world’s international internet traffic, links up pretty much all of the world’s data centers, those vast server warehouses where the computing happens that transforms all those 1s and 0s into our experience of the internet. Where those fiber-optic connections link up countries across the oceans, they consist almost entirely of cables running underwater—some 1.3 million kilometers (or more than 800,000 miles) of bundled glass threads that make up the actual, physical international internet. And until recently, the overwhelming majority of the undersea fiber-optic cable being installed was controlled and used by telecommunications companies and governments. Today, that’s no longer the case. In less than a decade, four tech giants— Microsoft, Google parent Alphabet, Meta (formerly Facebook ) and Amazon —have become by far the dominant users of undersea-cable capacity. Before 2012, the share of the world’s undersea fiber-optic capacity being used by those companies was less than 10%. Today, that figure is about 66%. (Wall Street Journal)

U.K. autonomous driving start-up Wayve has been backed by a host of big name investors including Microsoft, Virgin and Baillie Gifford in a $200 million funding round that brings total investment in the company up to $258 million. Wayve did not disclose its new valuation but it’s likely to be in excess of $1 billion, which would make it a so-called “unicorn” company. (CNBC)

Walmart filed seven U.S. patents examining the potential monetization of NFTs and the metaverse. (Blockworks)

Ralph Lauren CEO says metaverse is way to tap into younger generation of shoppers. (CNBC)

Smart Links

World's 10 richest men doubled wealth during pandemic. (Axios)

Orange-juice prices climb after forecasts for the smallest crop since 1945. (Wall Street Journal)

Spain moves to rein in crypto-asset advertising. (Reuters)

European sales of electric cars overtake diesel models for first time. (Financial Times)

Why enterprise software IPOs are outperforming other tech IPOs. (The Information)