(Click audio player above to listen)

Podcast: What Makes an Effective Board of Directors. In the time of an unprecedented global pandemic, boards – private and public – have been forced to re-examine priorities. And it’s not just trying to manage through Covid. ESG, diversity & inclusion, an evolving remote-work dynamic, a growing expectation that corporations will engage with social issues around race, gender and more. As companies face new challenges, what makes an effective board of directors? And how are companies with strong board compositions and engagement better equipped for turbulent times? To find answers, we spoke with Roberto Quarta. Roberto is Chairman of CD&R Europe, in addition to being Board Chair of WPP and Smith & Nephew. He is a former CEO and serves on both private and public boards. And as you’ll hear, to drive success, there’s one agenda in particular that has captured his attention – it’s what he calls the “human agenda.” (Working Capital Conversations)

The World

Tech blowout: Apple, Microsoft and Alphabet said their latest revenues and earnings had surged above the stock market’s already optimistic expectations, confirming that demand for their digital services and gadgets continued to soar as some countries began to emerge from the pandemic. (Financial Times, Wall Street Journal)

Microsoft reported its highest quarterly revenue ever, exceeding expectations, and it projected overall sales for the current quarter of up to $44.2 billion. Microsoft's increase in gaming revenue was bolstered by hardware sales, while Microsoft's Teams reaches nearly 250 million active monthly users.

Google parent Alphabet had its largest percentage jump in quarterly sales in more than 14 years, as retail accounts for the largest portion of Google’s advertising.

Apple posted its best fiscal third quarter in its 45-year history, though Apple tempered sales predictions for its current quarter ending in September, saying it expects revenue growth to be lower than the 36% it just reported in the June quarter, in part because of supply constraints.

President Biden warned that cyber attacks could escalate to full-blown war amid growing tensions with Russia and China at a time of escalating hacking incidents on American soil. Biden said that cyber threats including ransomware attacks “increasingly are able to cause damage and disruption in the real world.” “If we end up in a war, a real shooting war with a major power, it’s going to be as a consequence of a cyber breach,” he said at the Office for the Director of National Intelligence, which oversees 18 US intelligence agencies. (Financial Times)

US military leaders said they see Arctic operations as a deterrent to China, which has staked a claim to the region as part of its Belt and Road Initiative, and increasingly as a base for operations in the Indo-Pacific. (South China Morning Post)

As food grows scarce, North Korea accepts South's olive branch. North Korean leader Kim Jong Un and South Korean President Moon Jae-in start mending fences with the return of hotlines after a year of silence. (Nikkei Asian Review)

Developing economies’ limited access to Covid vaccines threatens to hinder the global economic recovery from the pandemic, the IMF has warned, as it upgraded its growth projections for advanced economies but lowered them for other parts of the world. The Fund still expects overall global growth of 6% this year. (Financial Times)

England is poised to reopen its borders as soon as next week by allowing fully vaccinated travelers from the EU and US to enter without quarantining. Ministers are expected to approve the plans today after Boris Johnson is said to have become concerned that the EU is ahead of Britain in enabling international travel. (The Times)

Fresh coronavirus outbreaks are forcing factory shutdowns in countries such as Vietnam and Bangladesh, aggravating supply chain disruptions that could leave some U.S. retailers with empty shelves as consumers begin their back-to-school shopping. “Nobody can get anything,” said Steve Lamar, CEO of the American Apparel and Footwear Association, “Do your Christmas shopping now.”(Washington Post)

White House staff told to wear masks again, as cases rise in the capital. (New York Times)

The number of Covid-19 cases across the US may have been undercounted by as much as 60%, researchers at the University of Washington have found. (The Guardian,

The Biden administration announced that long Covid, a condition where people experience long-term Covid-19 symptoms long after clearing the actual virus from their system, could be considered a disability under civil rights laws. (Politico)

Big drug companies and their lobbyists have a message for Congress: Don’t raise taxes on the industry that brought you fast-tracked Covid-19 vaccines. Pharma executives, lobbyists and consultants are mobilizing to fight what has become a threat to drug companies’ bottom lines: a sweeping agreement by many of the world’s biggest economies to better harmonize corporate taxation around the globe. Earlier this month, 130 countries agreed to broad outlines to establish a minimum corporate tax of 15% within their countries, reducing opportunities for international tax avoidance. (Wall Street Journal)

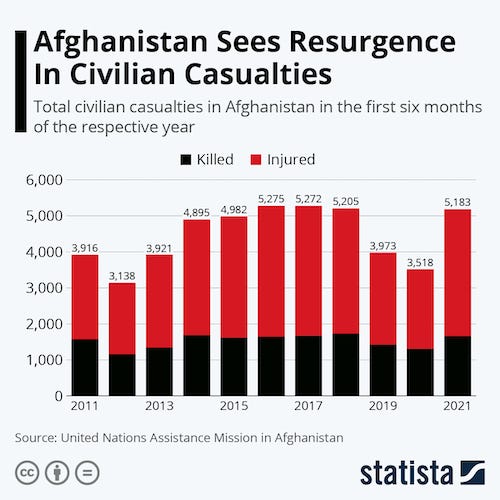

UN data from Afghanistan shows that the country experienced a resurgence in civilian deaths in 1H21. The toll has been particularly severe since the beginning of May when international forces commenced their final withdrawal at the same time as the Taliban launched a major offensive. (Statista)

Russia is stepping into the security vacuum created by the withdrawal of US troops from Afghanistan, with President Vladimir Putin looking to re-exert influence in central Asia and prevent Islamist extremism from spilling over the borders. (Financial Times)

Economy

The 20 Republican-led states that reduced unemployment benefits in June did not see an immediate spike in overall hiring, but early evidence suggests something did change: The teen hiring boom slowed in those states, and workers 25 and older returned to work more quickly. A new analysis by payroll processor Gusto, conducted for The Washington Post, found that small restaurants and hospitality businesses in states such as Missouri, which ended the extra unemployment benefits early, saw a jump in hiring of workers over age 25. The uptick in hiring of older workers was roughly offset by the slower hiring of teens in these states. In contrast, restaurants and hospitality businesses in states such as Kansas, where the full benefits remain, have been hiring a lot more teenagers who are less experienced and less likely to qualify for unemployment aid. The findings suggest hiring is likely to remain difficult for some time, especially in the lower-paying hospitality sector. (Washington Post)

Wall Street’s return to Manhattan dims suburban office dreams: It was a tantalizing idea early in the pandemic — With New York skyscrapers emptied and bankers hunkered down in homes outside the city, a handful of finance firms decided to scout alternate office locations in areas like New Jersey, Stamford and Long Island. That interest has fizzled. Much to the dismay of suburban brokers and landlords, the prospect of outposts in outlying areas failed to translate into deals. Instead, major Wall Street firms have ramped up return-to-office plans at their major hubs. (Bloomberg)

Work-from-anywhere perks give Silicon Valley a new edge in talent war: Startups in smaller markets feel pinch as coastal tech giants poach their employees; ‘a national competition’ for every hire. (Wall Street Journal)

U.S. economic growth will likely slow significantly in 2022 as the services sector’s recovery fades, according to Goldman Sachs. The U.S. bank expects the world’s biggest economy to return to trend-like expansion of 1.5%-2% in the second half of next year. It also cut its forecast for gross domestic product growth in the final two quarters of 2021 by one percentage point to 8.5% and 5% respectively. (Bloomberg)

Lysol. N95 Masks. UPS. For some pandemic winners, the boom is over. Growth is slowing for some businesses, adding to challenges as they deal with rising costs and supply constraints. (Wall Street Journal)

A selloff in Chinese technology stocks accelerated as investors unnerved by China’s widening crackdown on Internet companies and other industries sold down their holdings of many popular stocks. The Hang Seng Tech Index tumbled 8%, its third day of declines. The flagship Hang Seng Index dropped 4.2%. (Wall Street Journal)

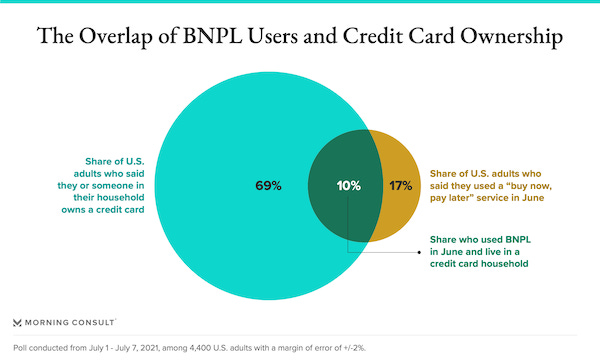

"Buy now, pay later" is becoming a commodity. Investors are pouring money into the sector, and established players are jumping in, too. CB Insights is tracking more than 50 "buy now, pay later" startups. So far in 2021, they've raised $2.1 billion in 20 deals. Visa, Shopify, Apple, Amazon, American Express and Citi are also playing in the space. Credit-card giants aren't going to give up their hold on consumer lending easily. (Protocol)

How ‘Buy Now, Pay Later’ consumers differ from credit card users. U.S. consumers who used a “buy now, pay later” service in June are more likely to be low income and report income volatility than those who live in a credit card household. BNPL users report less control over their finances than those who live in a credit card household. BNPL users also reported more progress towards financial goals such as eliminating debt than those with credit cards.(Morning Consult)

Technology

Facebook will limit ads children see after revelations Australian alcohol companies can reach teens. Meanwhile, Instagram introduced protections for its teenage users to default young people into private accounts and make it harder for "suspicious" adults to make unwanted contact. (The Guardian, NBC News)

Ratings for the Olympics are down generally, but NBC says streaming viewership of the Games is breaking records. Roughly $1 billion has been spent on advertising around the Olympics. At this point, traditional ratings are still the only real metric marketers can use to justify much of that spend. From Friday to Sunday, primetime coverage of the Olympics averaged 15.8 million viewers on across all NBC properties, down from 27.27 million across those three nights in 2016. A lot of the NBC's success this year will be determined by whether it can get people to subscribe to its streaming service, Peacock. But streaming may be part of the problem, as the myriad of viewing options and paywalls is likely causing some confusion for consumers. (Axios)

Five years ago, Salesforce paid $750 million to buy a startup called Quip that made an internet-based word processor and spreadsheet app meant to give Microsoft’s competing Office products a run for their money. That didn’t happen, but Salesforce did get a valuable asset out of the deal: Bret Taylor, Quip’s founder, who has risen to become the No. 2 executive at Salesforce. Now Taylor has the job of making sure the biggest deal in Salesforce’s history—its nearly $28 billion acquisition of Slack Technologies, which closed last week—works out better than its purchase of his startup did. Like Quip, Slack faces the formidable task of competing with a product from Microsoft. (The Information)

Activision Blizzard staff aim to walk out today, demanding fairer treatment for underrepresented staff and ending arbitration clauses in staff contracts. (Bloomberg)

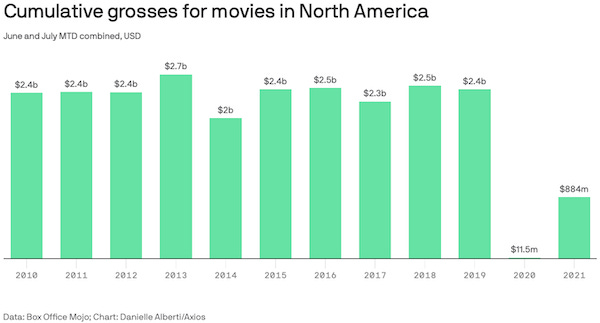

The theater recovery that wasn't: So far in June and most of July, with more than 80% of all theaters open, ticket sales are still about one-third of what they were on average during those months pre-pandemic. (Axios)

Smart Links

Canada border guards vote to strike days ahead of reopening to U.S. tourists. (Reuters)

Apple’s controversial Safari redesign is now optional in the latest iPadOS 15 beta. (The Verge)

Walmart now offering free college tuition and books to its 1.5 million U.S. employees. (Washington Post)

Foreign purchases of U.S. homes fall to new low. (Wall Street Journal)

U.K. home prices set to rise 9% this year, up from original 4% prediction. (Mansion Global)

Meeting global climate targets will lead to 8 million more energy jobs worldwide by 2050. (Science Daily)

Mayo Clinic named U.S. News top hospital for sixth straight year. (U.S. News & World Report)

NBC News adding 200+ jobs as part of major streaming push. (Axios)

Tech Blowout